Successfully negotiating claims since 1867

Retail Stores – Multiple UK Locations

Storm Damage & Resultant Claims Under ’72 Hours Clause’

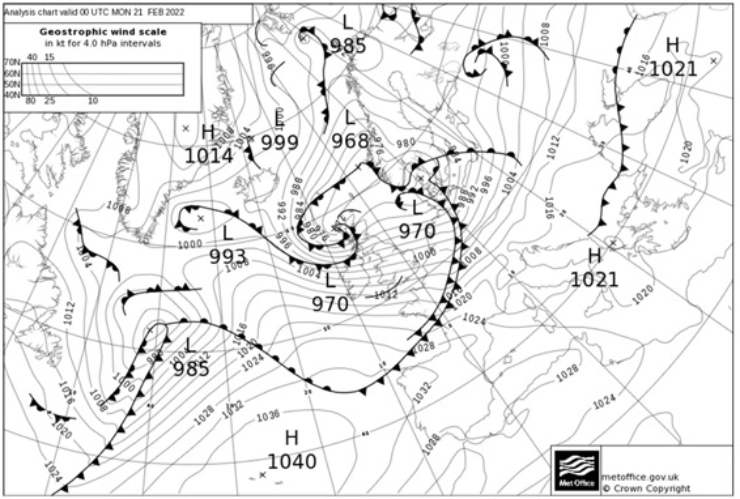

In February 2022, three ‘named’ storms, Dudley, Eunice and Franklin, occurred in the space of 6 days, resulting in major disruption. We were appointed to assess claims arising from damage and business interruption by several major UK retail brands, involving 198 stores located as far north as Inverness, to Plymouth in the south, Norwich in the east and Galway in the west.

What We Did

Businesses with multiple premises throughout the UK faced the risk of numerous concurrent incidents giving rise to losses that fell within their excess/deductible, preventing recovery under the policy. Many corporate and modern commercial combined policies include extensions to cover; variously described as 72 Hours, Occurrence, or Consecutive Damage Clauses. These extensions allow the policyholder to claim for losses arising from a single continuous cause occurring within a 72-hour period at any premises insured under the policy. As such, even where large deductibles apply, the aggregated claims are subject to a single deductible application.

We initially worked with our clients to identify all reported damage arising from the storms, based on which we produced schedules capturing evidence of damage, assessment reports and quotations for remedial works. In consultation with the clients and Insurers, we agreed the date of commencement for the 72 Hour period, to capture the losses concentrated in the period of greatest storm activity. Having liaised with the clients’ property team to collate invoices supporting reinstatement costs on a sample basis to satisfy the Insurers’ validation requirements, a claim comprising 158 premises was submitted.

The Outcome

Having agreed the period of indemnity and the operation of the 72 Hour Clause at an early stage, we negotiated a final settlement exceeding £300,000. In this case, the clients’ corporate policy contained a standard deductible of £25,000, applicable to any one property damage claim. The average value of storm damage on a pro rata basis amounted to only circa £2,000, albeit individual claims ranged from £300 to £13,000. Any of these losses would have fallen within the £25,000 deductible, producing no recovery under the policy. Applying the 72 Hour clause to aggregate, these losses produced a net settlement for the clients exceeding £280,000 which the clients were delighted with.